Affordable Care Act Metallic Plans

The Affordable Care Act (ACA) mandates that Qualified Health Plans (QHP) provide four levels of benefits or Actuarial Values (AV). There is a fifth classification of plans called Catastrophic coverage available to people under age 30.

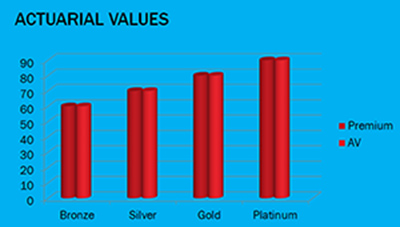

Actuarial Values range from:

- 60% for Bronze

- 70% for Silver

- 80% for Gold

- 90% for Platinum

The Actuarial Values are used to design a health insurance plan that will pay on average the appropriate Metallic level percentage of the covered annual combined medical expenses submitted for a particular Metallic level health plans issued by an insurance company.

Assume ABC insurance company has 10,000 Bronze plans issued. Assume the total of the covered medical bills (doctor visits, labs & X-rays, prescription drugs, and hospital stays) submitted to ABC insurance company for all Bronze plans was $1,000,000. The Bronze plans would pay out 60% of that or $600,000 on average. That does not mean "every" person who has a Bronze would get 60% of their medical bills paid.

In order for the average to be 60%, some would get 80% and some would get 40%. What each person gets would depend on the exact composition of their medical bills. If the only medical services you received for the year were preventative checkups, your bills would be paid at 100%.

Silver plans are designed to pay an average of 70% of the covered annual medical expenses of a Silver plan. Gold plans pay 80%, and Platinum plans pay 90%. The more the insurance plan pays, the less the patient pays. The more the insurance plan pays, the higher the premium.

Actuarial Values

An Actuarial Value is not the same thing as percent coinsurance. Many Bronze plans with an Actuarial Value of 60% have 80% coinsurance. An Actuarial Value of 60% means the plan will pay on average 60% of the covered hospital, labs, and prescription drug charges incurred by that plan type. A Silver plan would pay 70% of those charges.

An Actuarial Value is not the same thing as percent coinsurance. Many Bronze plans with an Actuarial Value of 60% have 80% coinsurance. An Actuarial Value of 60% means the plan will pay on average 60% of the covered hospital, labs, and prescription drug charges incurred by that plan type. A Silver plan would pay 70% of those charges.